XIRR(ROI) Calculator: Understanding the Concept and Key Features

As a developer, you may be familiar with financial calculation tools such as XIRR(ROI) Calculator. XIRR stands for Internal Rate of Return, and ROI stands for Return on Investment. This tool helps in determining the profitability or loss of an investment based on the cash flow generated. In this article, we will explore the concept of XIRR, how it works, and its key features for developers.

How XIRR Works

At its core, XIRR(ROI) is a complex mathematical formula that is used to calculate the rate of return for an investment that generates a series of cash flows. These cash flows may be irregular, or they may be spread out over a long period of time.

The XIRR(ROI) formula takes into account the time value of money, which means that it considers the fact that a dollar in the future is worth less than a dollar now due to inflation and other economic factors. This is important because it allows the formula to account for the fact that the same amount of money today can be worth more or less in the future.

To calculate the XIRR(ROI) for an investment, you need to know the initial investment amount, the series of cash flows generated by the investment, and the time periods at which those cash flows are received. Once you have this information, you can plug it into the XIRR(ROI) formula to calculate the rate of return for the investment.

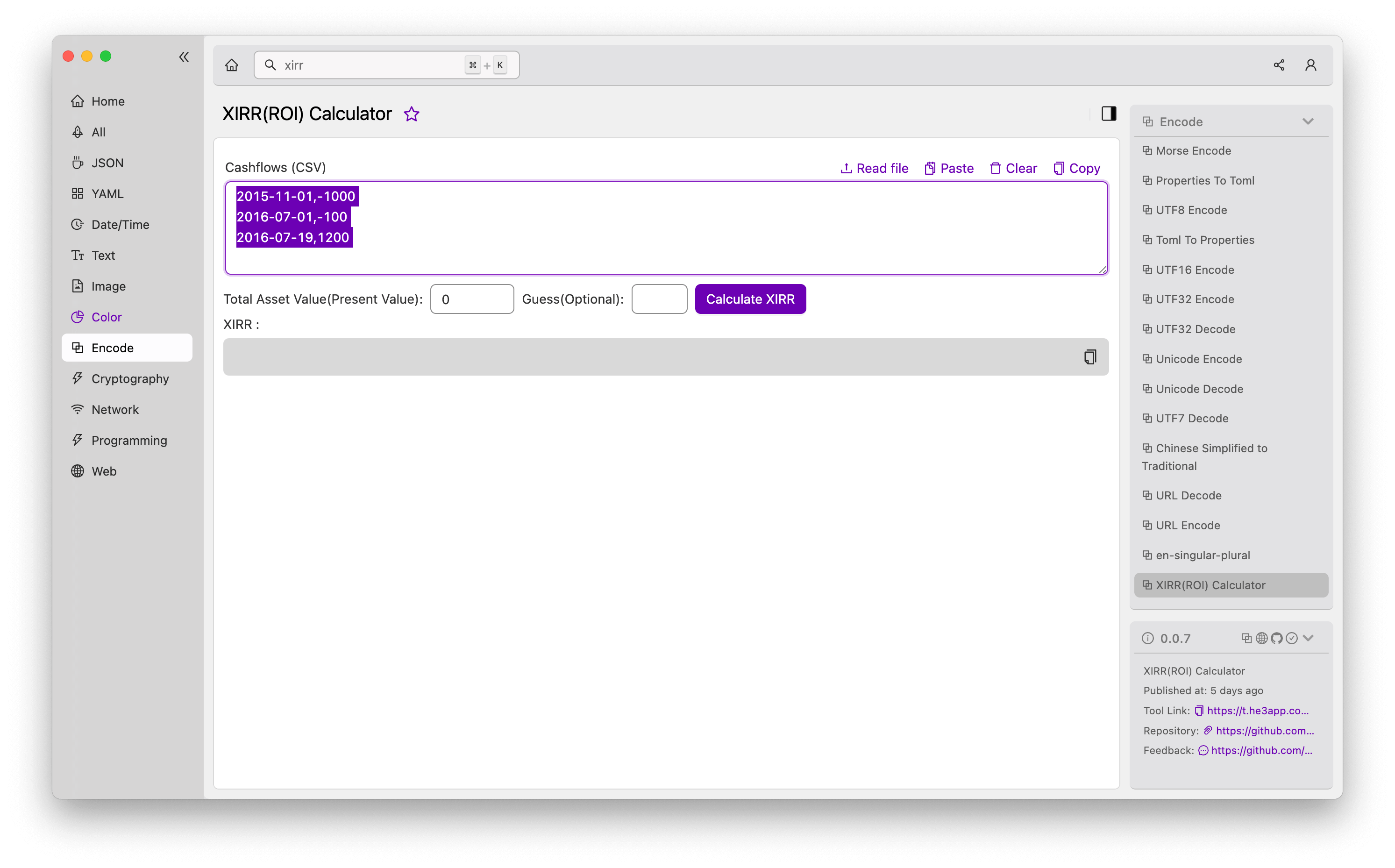

Or you can use XIRR(ROI) Calculator tool in He3 Toolbox (https://t.he3app.com?7b4d ) easily.

Key Features of XIRR(ROI) Calculator

Some of the key features of XIRR(ROI) Calculator include:

- Accurate Calculation: It can accurately calculate the rate of return for an investment based on irregular cash flows.

- Time Value of Money: It takes into account the time value of money, allowing for more accurate calculations.

- Multiple Investments: It can handle multiple investments with different cash flows and time periods.

- Easy to Use: XIRR(ROI) Calculator is easy to use and can be accessed through various financial software and calculators.

- Excel Integration: It can be easily integrated with Microsoft Excel to allow for easy calculation and analysis.

Scenarios for Developers

Developers can use XIRR(ROI) Calculator in various scenarios. For instance, you can use it for:

- Financial Modeling: To build financial models and analyze investment strategies.

- Investment Analysis: To analyze the performance of investments, evaluate different investment options, and compare different investment scenarios.

- Loan Analysis: To calculate the rate of return for loans or mortgages and compare different loan options.

Misconceptions and FAQs

Some misconceptions about XIRR(ROI) Calculator include:

- XIRR(ROI) is not the same as Simple Interest or Compound Interest calculations.

- XIRR(ROI) only takes into account the cash flows generated by an investment and does not consider other factors such as taxes, fees, or market risk.

Frequently Asked Questions about XIRR(ROI) Calculator:

-

Is XIRR(ROI) Calculator accurate for all investments and scenarios? XIRR(ROI) is accurate for most investments but may be affected by extreme or outlier cash flows.

-

What is a good XIRR(ROI) rate of return? A good XIRR(ROI) rate of return is subjective and depends on the investment, risk tolerance, and market conditions.

-

Is XIRR(ROI) Calculator the same for real estate investments? XIRR(ROI) can be used for real estate investments, but it may require additional factors such as depreciation and capital gains taxes in the calculation.

Conclusion

In conclusion, XIRR(ROI) Calculator is a powerful financial calculation tool that can help developers analyze different investment scenarios, calculate rate of return, and evaluate investment strategies. Its key features include accurate calculation, time value of money, multiple investments, easy use, and Excel integration. By understanding the concept of XIRR and its uses, developers can make informed investment decisions and build robust financial models.

References: