Understanding the Leverage Ratio Calculator for Developers

The Leverage Ratio Calculator is a financial tool designed to measure a company’s debt level and its capacity to pay its debt. The calculator helps to identify the proportion of debt to equity in a company’s capital structure, and this helps to determine the financial risk of the company. The ratio is obtained by dividing the company’s total debt by its total equity. It is commonly used by investors and analysts to evaluate a company’s financial standing, and it is an essential metric for financial analysis.

How it Works

The Leverage Ratio Calculator is used to calculate the leverage ratio of a company, which is a measure of its financial risk. The higher the leverage ratio, the greater the risk that a company will not be able to meet its financial obligations. The calculator works by dividing the company’s total debt by its total equity. The formula for the leverage ratio is as follows:

Leverage Ratio = Total Debt / Total Equity

Sample Code

Here is an example of how to calculate the leverage ratio using Python:

debt = 500000

equity = 1000000

leverage_ratio = debt / equity

print(leverage_ratio)Scenarios for Developers

Developers can use the Leverage Ratio Calculator in financial analysis to determine a company’s financial risk. Here are some scenarios where the calculator can be useful for developers:

- When developing financial applications that require the use of financial ratios

- When developing investment applications that require the assessment of the financial health of a company

Key Features Table

Here are some key features of the Leverage Ratio Calculator:

| Feature | Description |

|---|---|

| Ease of Use | The calculator is easy to use and requires minimal input |

| Accurate Results | The calculator produces accurate results that can be used for financial analysis |

| Time-saving | The calculator saves time that would have been spent doing manual calculations |

Misconceptions and FAQs

Misconception: The leverage ratio is the same as debt-to-equity ratio.

Although the leverage ratio and debt-to-equity ratio both measure a company’s debt level, they are not the same. The leverage ratio measures the total debt to equity, while the debt-to-equity ratio measures long-term debt to equity only.

FAQ 1: What is a good leverage ratio?

A good leverage ratio varies by industry, but generally, a leverage ratio of 2 or less is considered low-risk, while a ratio of 3 or higher indicates high risk.

FAQ 2: Can the leverage ratio be negative?

No, the leverage ratio cannot be negative as it is a ratio of two positive numbers.

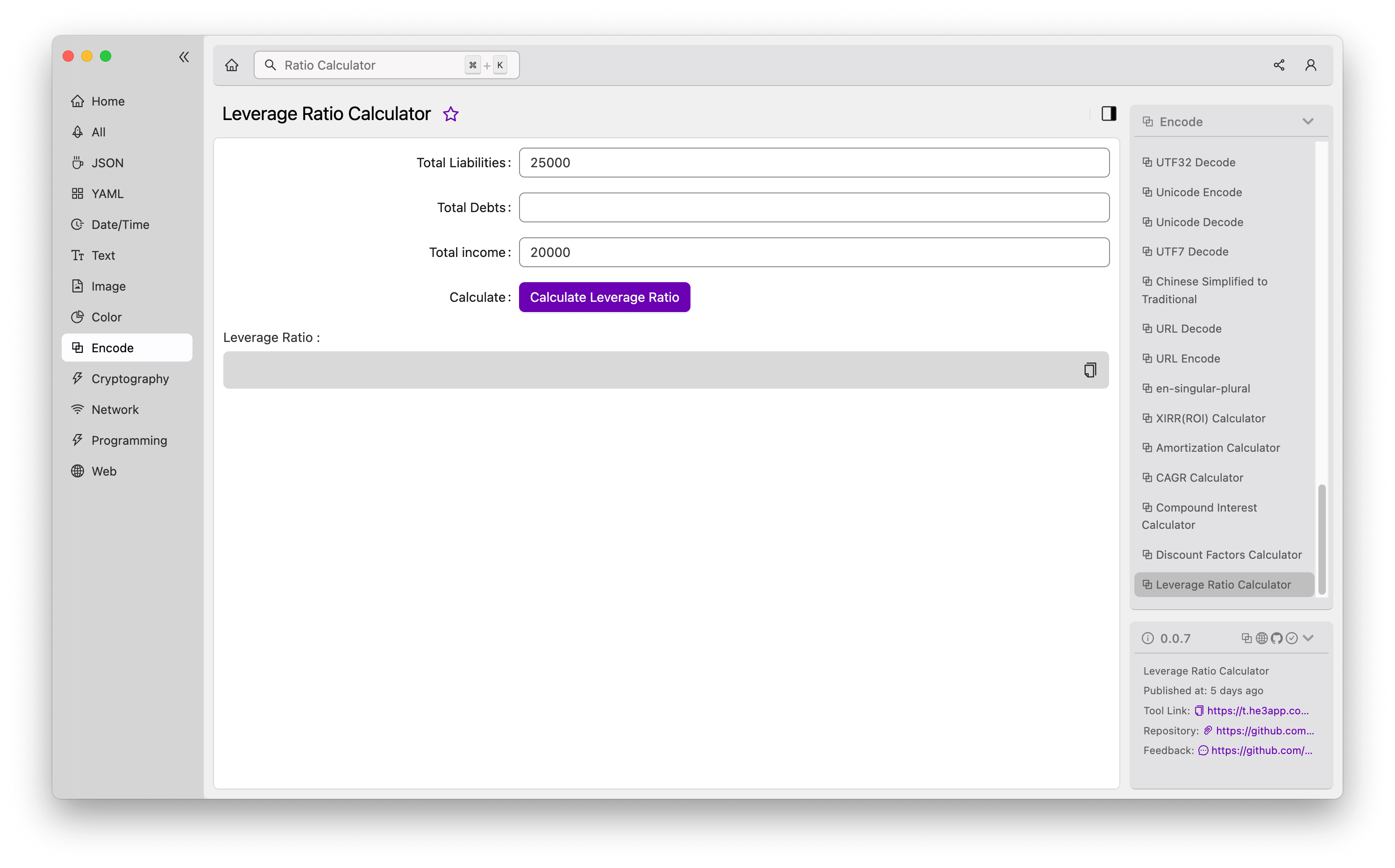

How to Use the Leverage Ratio Calculator

Developers can use the Leverage Ratio Calculator tool in He3 Toolbox (https://t.he3app.com?9swh ) easily.

In conclusion, the Leverage Ratio Calculator is an essential tool for investors and analysts who want to assess the financial risk of a company. It is easy to use, produces accurate results, and saves time that would have been spent doing manual calculations. Developers can use this calculator for financial analysis in a variety of scenarios, and it is an important metric in financial analysis. For more information, check out Wikipedia’s page on Financial Ratios.