Introduction

CAGR stands for Compound Annual Growth Rate, which is a financial metric used to calculate the growth rate of an investment over a specific period of time. This metric is useful for investors, financial analysts, economists, and developers to make important investment decisions. In this article, we will discuss the concept of CAGR Calculator, how it works, key features, scenarios for developers, misconceptions, and FAQs.

Understanding CAGR Calculator

CAGR Calculator is a finance tool that helps calculate the compound annual growth rate of an investment over a specific period of time. It’s a simple yet effective tool that takes into account reinvested dividends, interest, and capital gains. This tool is beneficial for investors who want to calculate their investment growth rate and make informed decisions. To calculate the CAGR, you need to know the initial investment value, the final investment value, and the number of years the investment was held.

How CAGR Calculator Works

The formula for calculating the CAGR is straightforward: CAGR = ((Final Value / Initial Value)^ (1 / Number of Years)) - 1 To make things easier, you can use CAGR Calculator tools to calculate the CAGR of your investment. The calculator uses the above formula to determine the compound annual growth rate of your investment.

Example:

Suppose you invest $10,000 in an investment and after five years, your investment grows to $15,000. What is the CAGR of your investment? CAGR = ((15,000 / 10,000) ^ (1/5)) - 1 = 8.68%

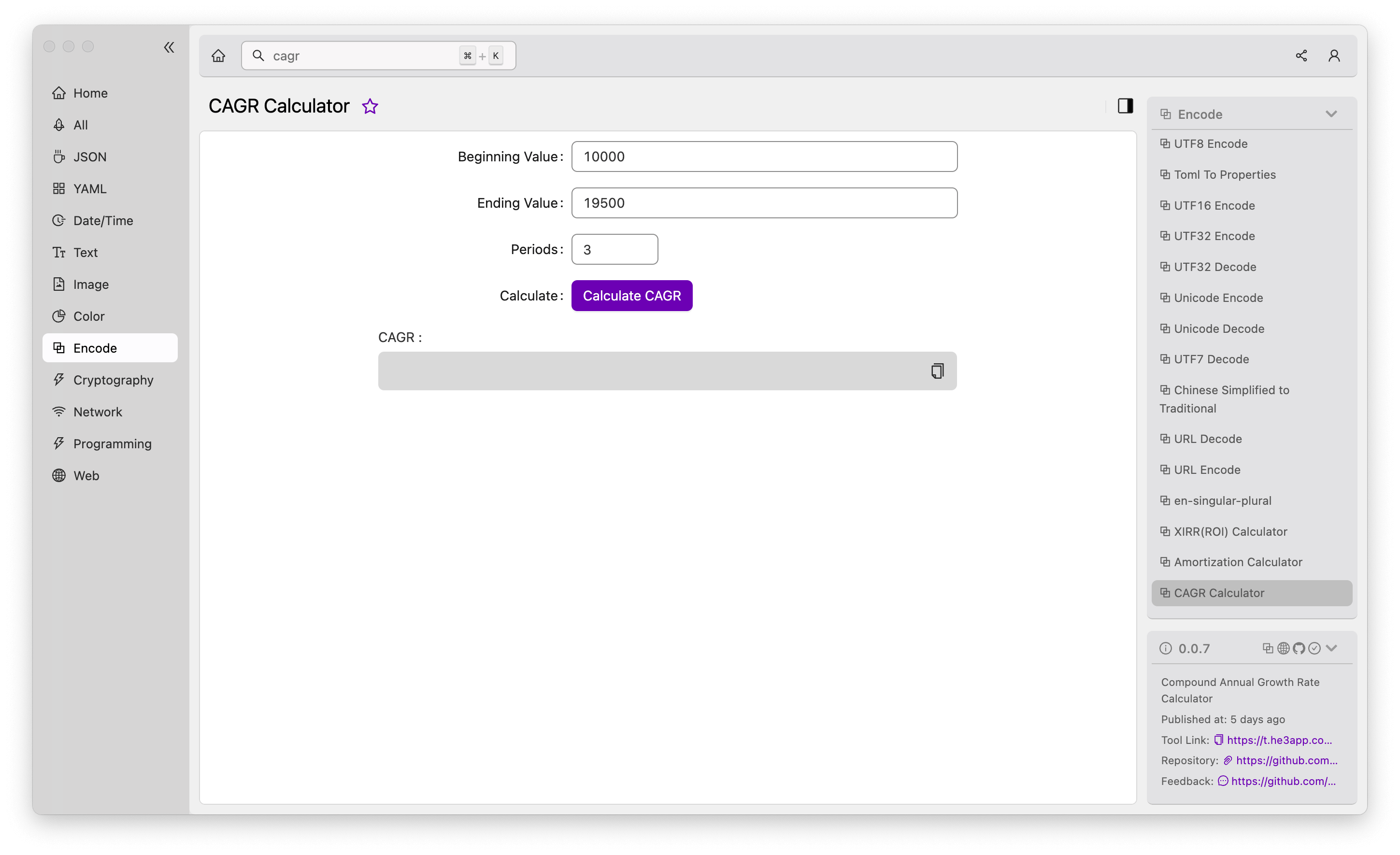

Or you can use CAGR Calculator tool in He3 Toolbox (https://t.he3app.com?6eu8 ) easily.

Key Features of CAGR Calculator

CAGR Calculator tools offer several key features, including:

- Easy to use interface

- Accurate and precise results

- Supports multiple currencies

- Option to alter the investment period

- Compatible with different investment types.

Scenarios for Developers

Developers can use CAGR Calculator tools to build powerful investment applications that provide users with accurate and timely investment data. With CAGR Calculator, developers can create financial applications, mobile applications, and web applications that make it easy for investors and financial analysts to calculate the growth rate of their investment portfolio.

Misconceptions about CAGR Calculator

There are several misconceptions about CAGR Calculator, including:

- It assumes a linear growth rate, which may not reflect the true nature of the investment.

- It doesn’t account for the effect of inflation, which can significantly impact investment returns.

- It assumes the reinvestment of dividends or capital gains, which may not be realistic.

FAQs

Q1. What is the best use case for the CAGR Calculator?

The best use case for the CAGR Calculator is to calculate the growth rate of your investment over a specific period of time accurately. It’s beneficial for investors who want to calculate their returns and make informed decisions.

Q2. What are the limitations of the CAGR Calculator?

The limitations of the CAGR Calculator are that it assumes a linear growth rate, doesn’t account for the effect of inflation, and assumes reinvestment of dividends or capital gains.

Q3. What is the difference between CAGR and annualized return?

CAGR accounts for the effect of compounding, while the annualized return doesn’t. The CAGR is a more accurate measure of investment performance as it takes into account the growth of the investment over time.

Conclusion

In conclusion, CAGR Calculator is an essential tool for developers and investors who want to calculate the growth rate of their investments accurately. With its ease of use, accuracy, and precision, the tool can help developers create powerful investment applications that provide accurate and timely investment data.

References: