Introduction

The world of finance is an ever-evolving one, and Loan Calculators have become an essential tool for people to calculate their loan payments. An Amortization Calculator is a specific type of Loan Calculator that allows users to determine the payments on their loans, including principal and interest amount. In this article, we will explain the concept of an Amortization Calculator, how it works, and how developers can use it to create their own Loan Calculator tool.

How it Works

Amortization is the process of spreading out a loan into a series of fixed payments over time. A loan’s amortization schedule shows the amount of each payment allocated to interest and principal. An Amortization Calculator automates the process of calculating these payments and displaying them to the user.

When creating an Amortization Calculator, the developer needs to take several factors into account. These factors include the loan amount, the interest rate, the loan duration, and the payment frequency. Once these factors are inputted into the calculator, it will calculate the monthly payment amount, total interest paid, and the total amount paid over the life of the loan.

The formula for calculating an Amortization Schedule is as follows:

P = (Pv * r) / (1 - (1 + r) ^ -n)where P is the monthly payment, Pv is the present value or loan amount, r is the interest rate per month, and n is the total number of payments.

Scenarios for Developers

Developers can use an Amortization Calculator to create a Loan Calculator tool that can be integrated into their website or application. This tool can be used by customers to calculate their loan payments and get a better understanding of their financial obligations.

Creating an Amortization Calculator is a fairly straightforward process. Developers can use a variety of programming languages such as JavaScript or Python to build the calculator. There are also several libraries and frameworks available that can simplify the development process.

Key Features

Here are some key features that developers can consider when creating an Amortization Calculator:

| Feature | Description |

|---|---|

| Loan Amount | The initial amount of the loan |

| Interest Rate | The annual interest rate applied to the loan |

| Loan Duration | The length of the loan in months or years |

| Payment Frequency | The frequency of the loan payments (monthly, biweekly, weekly, etc.) |

| Payment Amount | The amount of the monthly loan payment |

| Total Interest Paid | The total amount of interest paid over the life of the loan |

| Total Amount Paid | The total amount of the loan plus interest |

Misconceptions and FAQs

Misconceptions

- An Amortization Calculator only calculates the principal and interest payments.

While it is true that an Amortization Calculator’s primary purpose is to calculate the principal and interest payments, it can also calculate other types of loan payments. These include balloon payments, additional payments, and payments that vary over time.

FAQs

- Can I customize the Amortization Calculator’s look and feel?

Yes, developers can customize the Amortization Calculator’s look and feel to match their website or application’s design.

- How accurate are Amortization Calculators?

Amortization Calculators are highly accurate and reliable. However, the accuracy of the calculator depends on the input data’s accuracy. Developers should ensure that the fields are well-labeled and have clear instructions to ensure that the input data is accurate.

Conclusion

An Amortization Calculator is an essential financial tool that allows users to calculate their loan payments easily. Developers can use the concept of an Amortization Calculator to create their own Loan Calculator tools using programming languages such as JavaScript or Python. These tools can be easily integrated into websites or applications and provide users with accurate and reliable loan payment information.

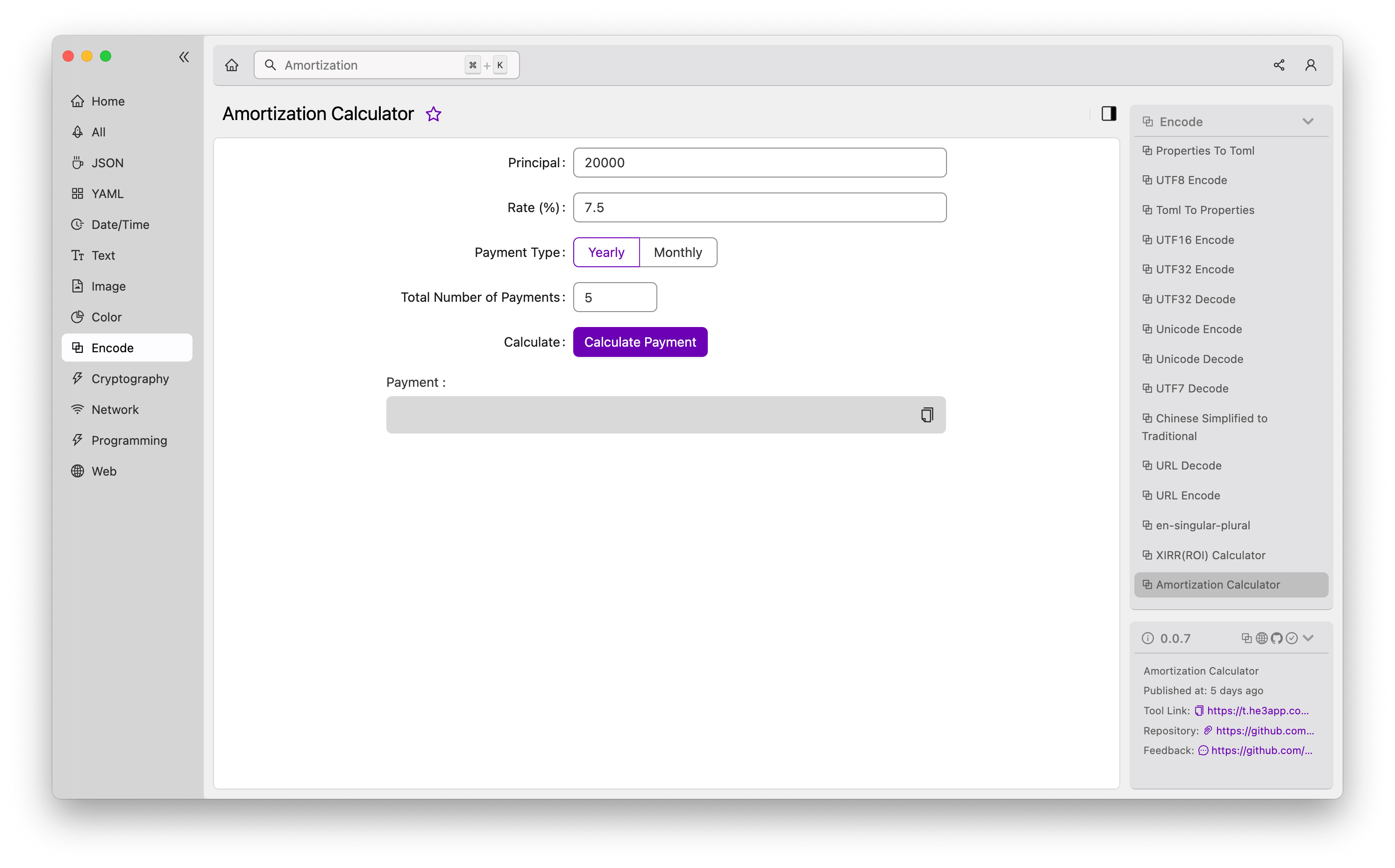

Or you can use Amortization Calculator tool in He3 Toolbox (https://t.he3app.com?s85y ) easily.

References: