Discount Factors Calculator is a tool used in finance to help calculate the present value of a future payment or series of payments by discounting them at the current market interest rate. It takes into account the time value of money and allows investors to determine the true value of future cash flows. Developers can utilize Discount Factors Calculator to help create financial models and projections.

How It Works

Discount Factors Calculator utilizes a formula to calculate the present value of future cash flows. This formula takes into account the rate of return and the time period in which the payment will be made. The formula is:

PV = FV / (1 + r)^nWhere:

- PV = Present Value

- FV = Future Value

- r = Discount Rate

- n = Number of periods

Developers can use this formula to calculate the present value for a single payment or multiple payments over time. They can then use this information to make informed financial decisions.

Sample Code

Here is an example of how to calculate the present value of a single payment using Discount Factors Calculator:

def present_value(future_value, discount_rate, time_periods):

discount_factor = 1 / (1 + discount_rate) ** time_periods

return future_value * discount_factorTo calculate the present value of a payment of $100, discounted at a rate of 5% over 5 years, the developer would use the following code:

present_value(100, 0.05, 5)This would return a present value of $78.35.

Scenarios for Developers

Developers can use Discount Factors Calculator to create financial models and projections for a variety of scenarios. They can use it to determine the present value of an investment, calculate the value of a series of future cash flows, or determine the value of a future payment stream.

Key Features

Here are some key features of Discount Factors Calculator:

| Feature | Description |

|---|---|

| Present Value Calculation | Calculates the present value of future payments based on current market interest rates |

| Discount Rate | Allows users to input the current market interest rate |

| Time Periods | Allows users to input the number of periods over which the payment will be made |

| Single or Multiple Payments | Can calculate the present value of a single payment or a series of payments over time |

Misconceptions

There are some misconceptions surrounding Discount Factors Calculator. One of the biggest misconceptions is that it only works for fixed-rate investments. In reality, Discount Factors Calculator can be used for any investment where the rate of return is known.

Another misconception is that it can only be used for investments with a single payment. While it can be used for single payments, it can also be used for investments with multiple payments over time.

FAQs

Q: Can Discount Factors Calculator be used for investments with variable rates of return?

A: Yes, Discount Factors Calculator can be used for any investment where the rate of return is known, regardless of whether it is fixed or variable.

Q: Can Discount Factors Calculator be used for investments with irregular payment streams?

A: Yes, Discount Factors Calculator can be used for investments with irregular payment streams, but the calculations may be more complex.

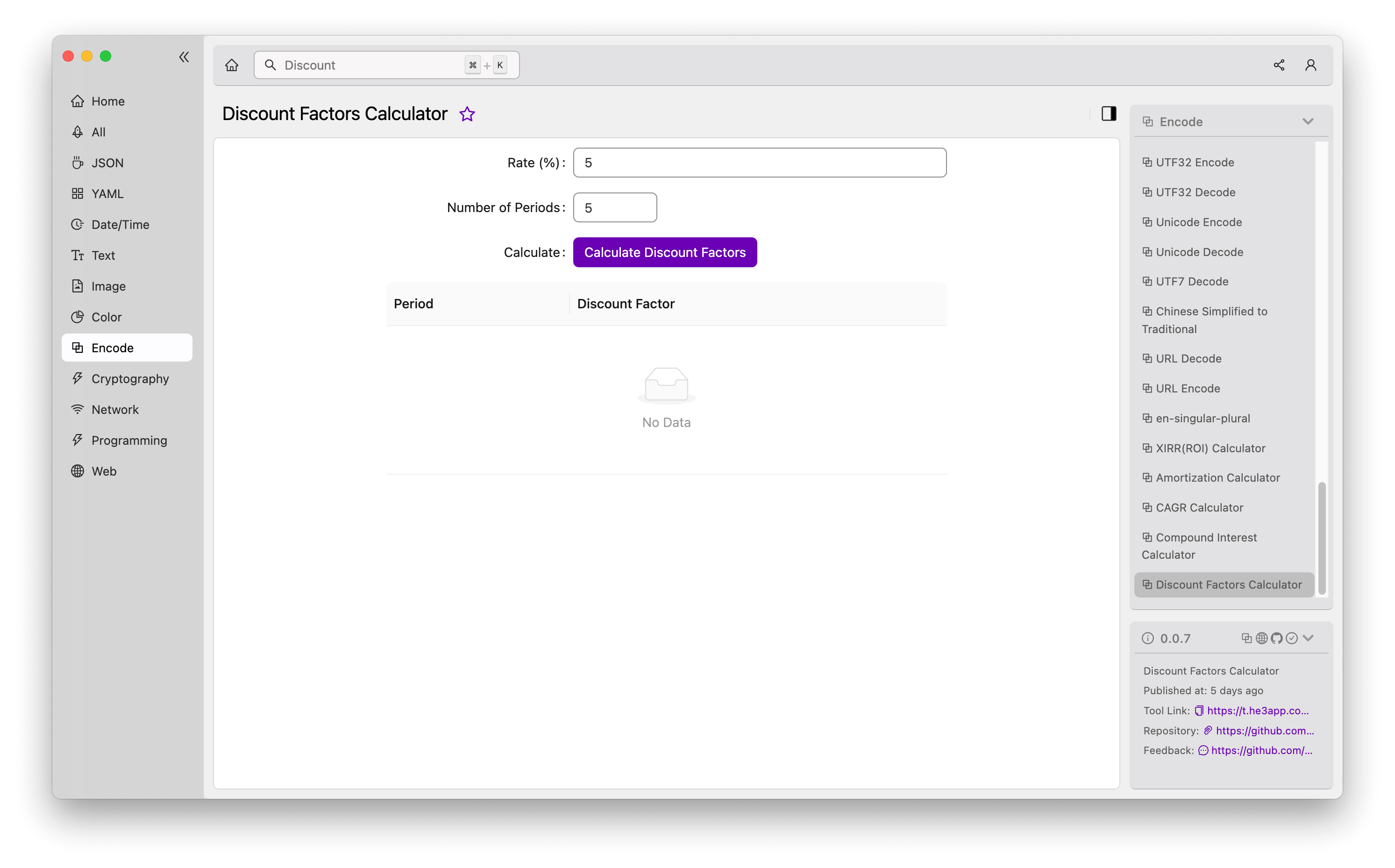

Or you can use Discount Factors Calculator tool in He3 Toolbox (https://t.he3app.com?skbm ) easily.

Conclusion

Discount Factors Calculator is a valuable tool for developers working in finance. It helps calculate the present value of future payments based on current market interest rates and can be used for a variety of investment scenarios. By understanding the concept and utilizing this tool, developers can make informed financial decisions and create accurate financial models.

Reference links: